Thin credit files limit traditional loan options, pushing borrowers towards car title loans with higher interest rates and shorter terms in San Antonio and Houston. These alternative financing methods use vehicle equity but require careful understanding of risks for individuals with limited financial histories.

Many individuals find themselves with a ‘thin credit file’, lacking substantial historical data due to their age or lack of financial activities. This can create challenges when seeking traditional loans, pushing them towards alternative solutions like car title loans. These loans, secured by a vehicle’s title, offer access to capital for those with limited credit history. However, understanding the pros and cons is crucial before taking this route, weighing potential benefits against possible drawbacks.

- Understanding Thin Credit Files: Challenges and Implications

- Car Title Loans: An Option for Borrowers with Limited History

- Pros and Cons of Using Car Titles for Financial Support

Understanding Thin Credit Files: Challenges and Implications

Thin credit files present a unique challenge for borrowers, especially when seeking traditional loan approvals. In today’s digital era, many individuals have limited or sparse financial histories recorded, often due to young age, lack of credit usage, or a history of poor financial management. This can make it difficult for lenders to assess an applicant’s creditworthiness, leaving them hesitant to offer loan approval. As a result, those with thin credit files often turn to alternative financing options, such as car title loans, which require less stringent credit checks.

This situation has implications for borrowers’ future financial well-being. While car title loans can provide much-needed financial assistance in emergencies or for short-term needs, they typically come with higher interest rates and shorter repayment periods compared to conventional loans. Borrowers must carefully consider these factors and ensure they have a plan to repay the loan without falling into a cycle of debt. Understanding the challenges of thin credit files is crucial for both lenders and borrowers to navigate this landscape effectively.

Car Title Loans: An Option for Borrowers with Limited History

For individuals with a thin credit file or poor credit history, securing traditional loans can be an uphill battle. Many banks and financial institutions require extensive borrowing histories and strict loan requirements to approve borrowers, leaving those with limited or no credit records struggling to access funding. This is where car title loans step in as an alternative option for San Antonio loans.

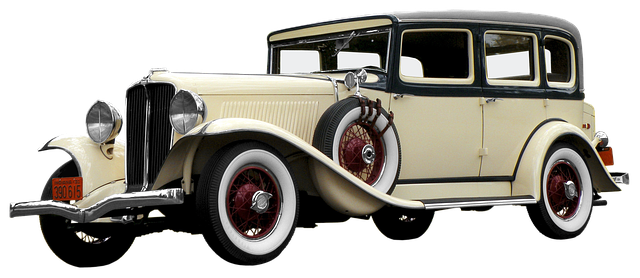

A car title loan is a type of secured loan that uses a vehicle’s registration, specifically the car title, as collateral. Unlike conventional loans that heavily rely on credit scores, car title loans focus more on the equity and value of the vehicle. This makes them accessible to borrowers with bad credit or thin credit files, providing an opportunity for those in need of quick funding to get San Antonio loans without the usual loan requirements.

Pros and Cons of Using Car Titles for Financial Support

For individuals with thin credit files, traditional loan options often prove elusive, prompting many to explore alternative financing methods. Car title loans have emerged as a popular choice for those seeking financial support despite their limited credit history. This option allows borrowers to use their vehicle’s equity as collateral, providing access to funds relatively quickly. It can be particularly beneficial in cities like Houston where car ownership is high, offering a solution for immediate financial needs.

While car title loans can provide much-needed cash flow, there are considerations. These loans often come with higher interest rates compared to conventional loans due to the shorter term and collateral requirement. Repayment terms are typically more stringent, and borrowers must be prepared to make flexible payments to avoid default. Houston Title Loans, for instance, may offer a straightforward process, but borrowers should carefully understand the loan requirements and potential risks before pledging their vehicle’s title as security.

Many individuals with thin credit files find themselves limited in their borrowing options, but car title loans offer a unique solution. This alternative financing method provides access to funds for those who lack extensive credit history, addressing an often-overlooked need. While it presents advantages such as easier accessibility and faster approval, it’s crucial to weigh the potential drawbacks, including higher interest rates and the risk of losing one’s vehicle if repayments fail. Understanding both the benefits and risks is essential when considering a car title loan as a thin credit file borrower.