Car title loans offer a unique financial solution for individuals with thin or poor credit, focusing on vehicle equity rather than credit history. While lenders heavily rely on credit reports, making it challenging for those with limited data points to access funding, strategic approaches can help mitigate defaults. Key strategies include transparent communication, flexible repayment options, and leveraging quick approval processes to create sustainable repayment plans for borrowers with thin credit files.

Car title loans, a popular alternative financing option, often cater to borrowers with limited credit history or ‘thin’ credit files. However, this accessibility comes with risks; defaults are significantly more common among these lenders due to stringent requirements and high-interest rates. This article delves into the interplay between car title loans and thin credit files, exploring their impact on default rates and offering strategies for borrowers to navigate this financial landscape more safely.

- Understanding Car Title Loans and Credit Files

- The Impact of Thin Credit Files on Loan Defaults

- Strategies to Mitigate Defaults for Borrowers with Thin Credit Files

Understanding Car Title Loans and Credit Files

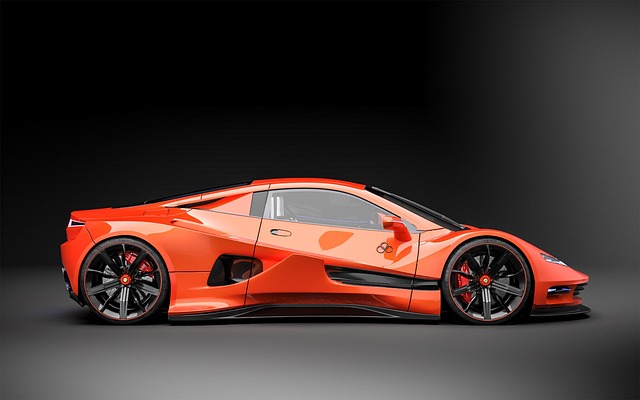

Car title loans are a type of secured lending that uses a vehicle’s equity as collateral. Unlike traditional loans that rely heavily on credit scores and histories, car title loans assess a borrower’s ability to repay based on the value and condition of their vehicle. This makes them an attractive option for individuals with thin or poor credit files, as it offers a chance for quick funding without extensive financial scrutiny.

A thin credit file refers to a limited or non-existent credit history, which can make it challenging for borrowers to secure conventional loans. However, car title loans provide an alternative by focusing on the vehicle’s equity rather than the borrower’s creditworthiness. This is particularly beneficial for those in need of immediate funds, such as semi truck owners looking for quick funding to cover unexpected repairs or business expenses.

The Impact of Thin Credit Files on Loan Defaults

Having a thin credit file, or limited credit history, can significantly impact an individual’s ability to secure loans, particularly when it comes to Car Title Loans in Fort Worth. Lenders often rely on credit reports to assess risk and determine eligibility for borrowing. When a borrower has minimal credit data, it becomes challenging for lenders to accurately gauge their financial responsibility and predict repayment behavior. This uncertainty can lead to higher default rates.

In the case of Car Title Loans, where vehicles are used as collateral, thin credit files may result in stricter lending criteria. Lenders might require additional forms of verification or offer lower loan amounts to mitigate potential losses. While this approach aims to protect lenders, it can also limit access to funding for individuals with limited credit history. It’s a delicate balance between ensuring responsible lending and providing financial opportunities for those who may be new to the credit market.

Strategies to Mitigate Defaults for Borrowers with Thin Credit Files

For borrowers with thin credit files, navigating car title loans can be challenging, but several strategies can help mitigate defaults. First, understanding and clearly agreeing upon loan terms is paramount. Transparent communication with lenders about one’s financial situation and capabilities ensures a manageable repayment plan. Loan terms should be tailored to the borrower’s income and expenses, aiming for a balance that doesn’t strain their budget.

Second, exploring flexible repayment options can significantly reduce the risk of default. Many lenders offer various repayment schedules, allowing borrowers to choose the one best suited to their cash flow patterns. Quick approval processes are also beneficial; faster access to funds means less time for financial stress and a higher likelihood of successful repayment.

Car title loans can be a viable option for individuals with thin credit files, but it’s crucial to understand that defaults are more common among this demographic. By implementing strategies like responsible borrowing, maintaining regular communication with lenders, and exploring alternative credit-building methods, borrowers can mitigate the risk of default. Understanding the impact of thin credit files is the first step towards making informed decisions when pursuing a car title loan.